It’s Tax Season!

Are you eligible now or in 2022, to take a QCD from an IRA?

It’s Tax Season

Are you currently eligible to take a Qualified Charitable Distribution (QCD) from an IRA? Will you become eligible in 2022? You may be able to make a QCD before the April 18th tax season filing deadline that will count toward your 2021 taxes.*

Or, if you become eligible this year, you can plan ahead for your year-end charitable giving—it’s never too early! Below are two resources for more information.

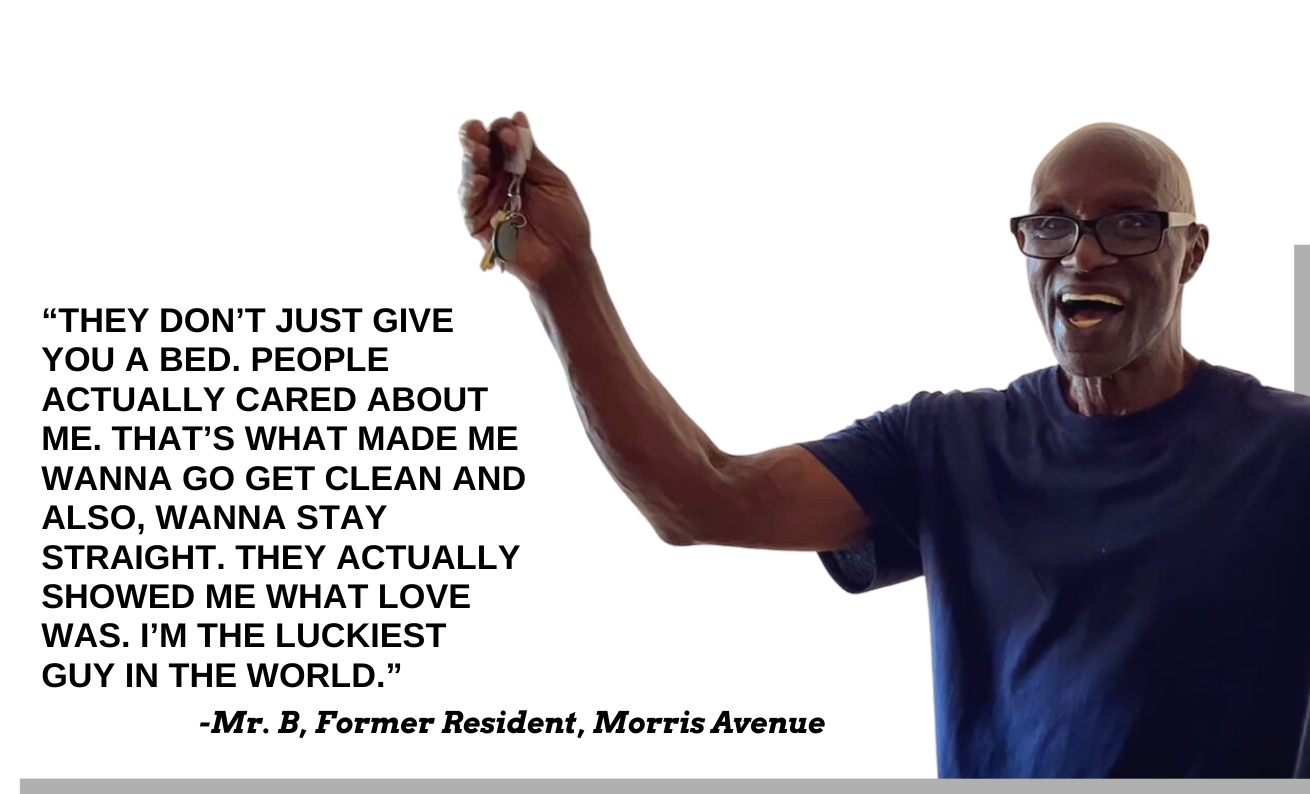

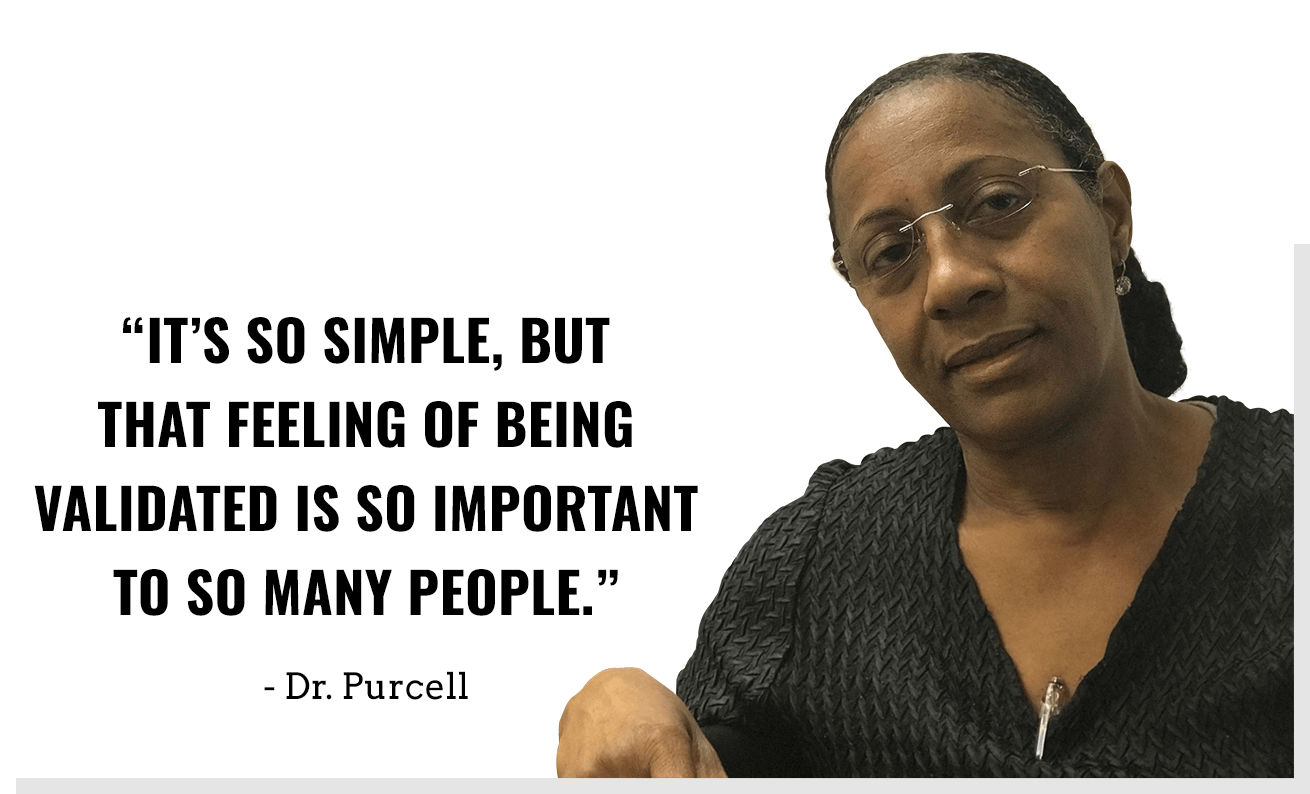

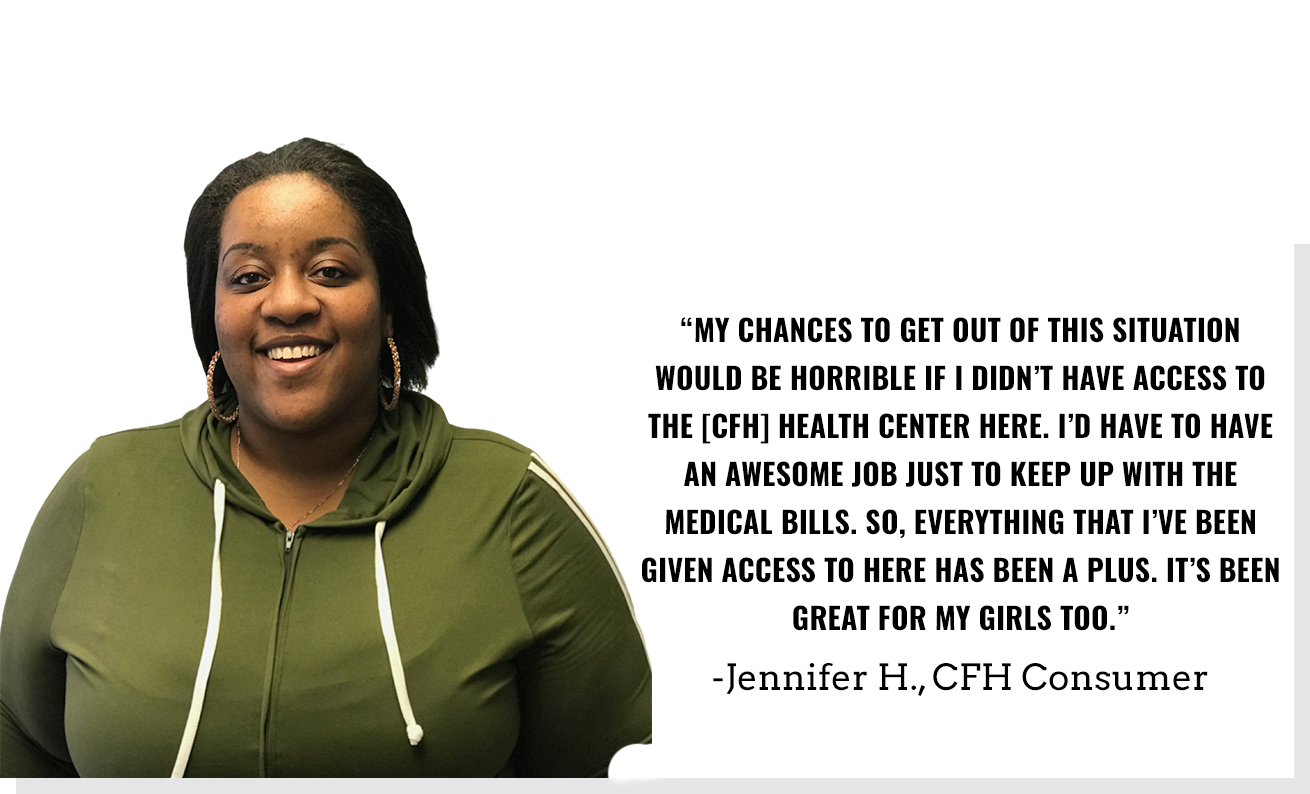

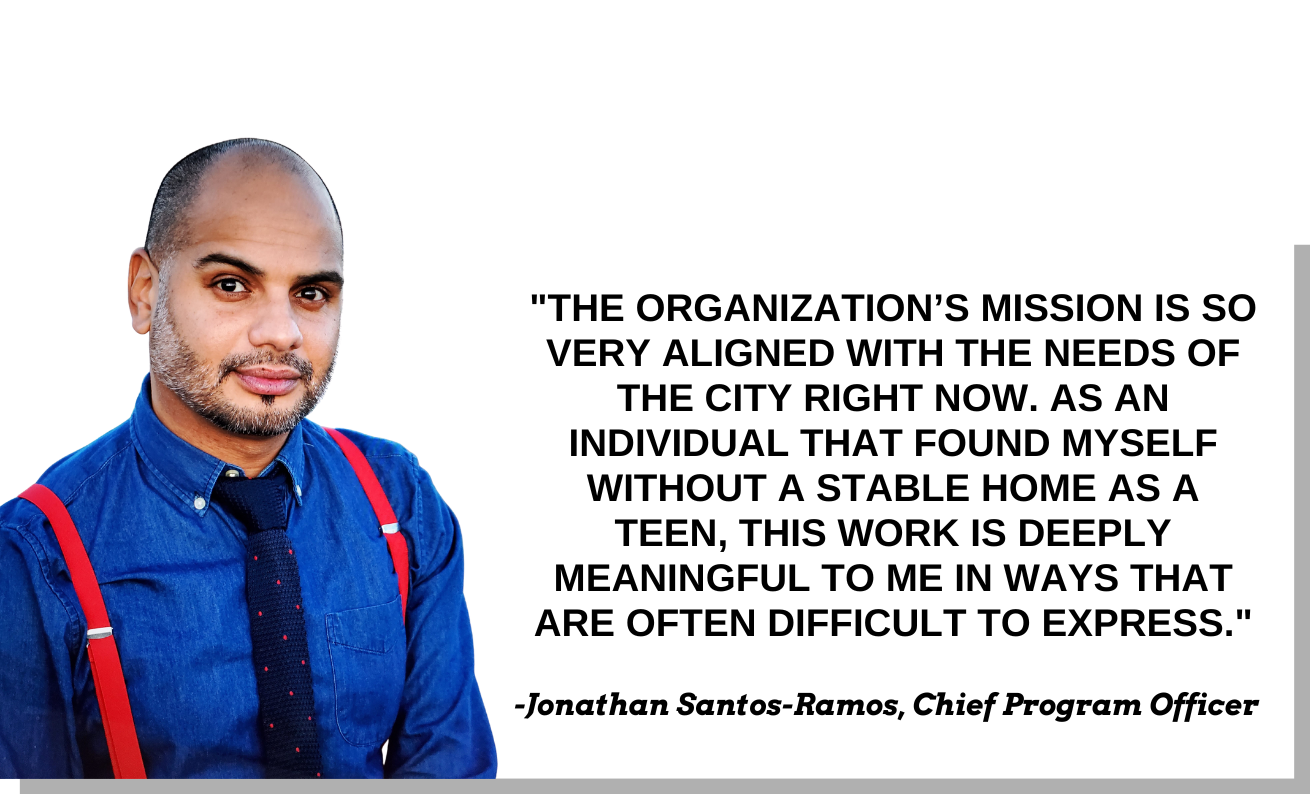

What Your Gift Means

Making a QCD to Care For the Homeless can not only benefit you but will make a true impact to homeless New Yorkers that turn to us for help.

(Hint: if you do choose CFH for a QCD, please let us know so we can be sure to thank you! Contact Cathy at csharp@cfhnyc.org. Thank you!)

Disclaimer

*The information above is not intended to be tax or financial advice; CFH does not endorse any author or company referenced in this article. Please consult a tax expert or your advisor to determine your eligibility regarding the information above. Please contact your IRA custodian to discuss your interest in making a QCD to CFH or another nonprofit.